Navigating the process of securing a commercial construction loan in Frederick, MD, can be complex. With Frederick’s booming commercial sector, understanding the local market is crucial for a successful project. The city’s strategic location and expanding infrastructure offer abundant opportunities for commercial development, making local lending knowledge essential.

At Contour Construction, our deep industry expertise and strong local connections ensure a seamless loan process, providing tailored solutions for your commercial needs. Our commitment to quality and personalized service makes us a trusted partner in Frederick’s commercial construction market. Discover how Contour Construction can help you achieve your business goals in Frederick, MD.

Understanding Commercial Construction Loans

Acquiring a commercial construction loan with a professional company simplifies the financing process, ensuring all legalities and requirements are met efficiently. This guidance is vital for navigating the complexities of commercial development.

Professional lenders manage disbursements, schedules, and budgets, allowing you to focus on the project itself. Their oversight reduces stress and potential delays, enabling smoother execution and adherence to timelines.

Studies show that projects with professional loan management are 25% more likely to stay on budget and meet deadlines, reinforcing the value of expert guidance. Choosing a reputable lender ensures industry expertise and robust local knowledge, driving your project’s success.

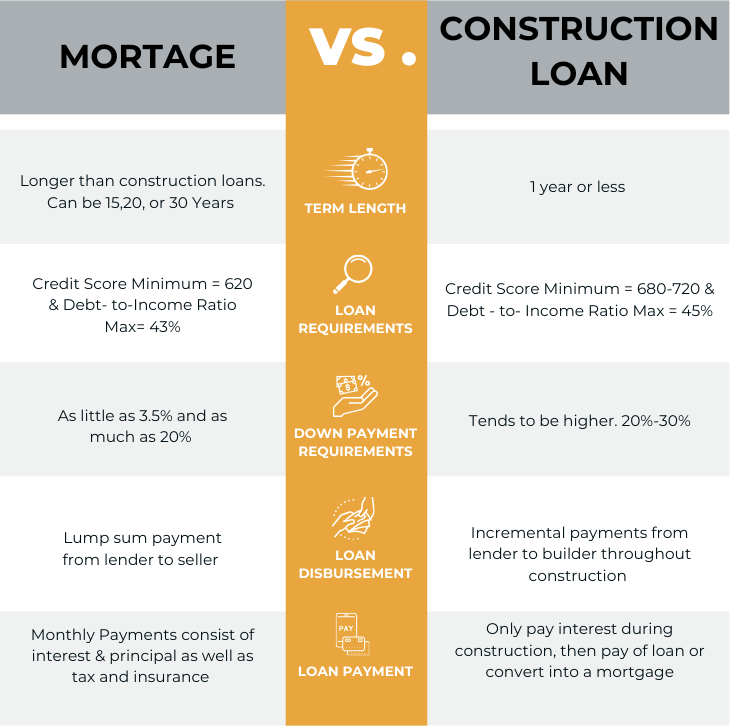

Difference Between Commercial Construction Loans and Traditional Mortgages

Commercial construction loans are tailored for developing new commercial properties, offering staged funds aligned with construction milestones. This flexibility ensures liquidity when needed, minimizing financial strain during the project.

In contrast, traditional mortgages are suited for purchasing existing properties, providing long-term stability with lower interest rates. However, they lack the tailored support and flexibility crucial for commercial development. Understanding these distinctions empowers informed decision-making in selecting the right financing for your commercial ventures.

Types of Commercial Construction Loans

Navigating the variety of commercial construction loans available is critical for commercial developers seeking tailored financing solutions. Understanding the distinct advantages of each type—whether it’s streamlining the transition from construction to occupancy, providing flexibility during the building phase, or funding renovations—empowers businesses to choose the most suitable option for their specific project needs.

- Construction-to-Permanent Loans: These loans streamline the financing process by combining construction financing and mortgage into a single loan. They are ideal for projects where the intention is to build and occupy the property upon completion. This type of loan eliminates the need for separate approvals and closing costs associated with two loans.

- Stand-Alone Construction Loans: Stand-alone construction loans provide financing specifically for the construction phase of a project. They are suitable when permanent financing, such as a mortgage, will be obtained separately after the construction is complete. This option offers flexibility during the construction phase, focusing solely on funding the building process.

- Renovation Loans: Renovation loans are designed for projects involving significant improvements or renovations to existing properties. They provide financing to enhance the property’s value and functionality without the need for a complete rebuild. Renovation loans are beneficial for revitalizing commercial properties while managing costs effectively.

Each type of commercial construction loan serves distinct purposes, offering flexibility and tailored financial solutions to meet the specific needs of commercial development projects. Understanding these options helps in choosing the most suitable financing strategy for your project.

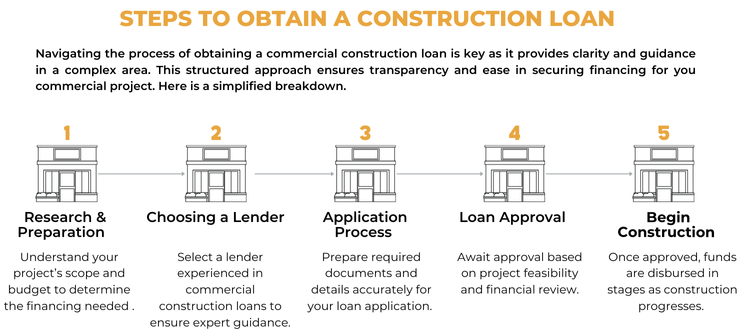

Steps to Obtain a Construction Loan

Navigating the process of obtaining a commercial construction loan is key as it provides clarity and guidance in a complex area. Here is a simplified breakdown:

- Research and Preparation: Understand your project’s scope and budget to determine the financing needed.

- Choosing a Lender: Select a lender experienced in commercial construction loans to ensure expert guidance.

- Application Process: Prepare required documents and details accurately for your loan application.

- Loan Approval: Await approval based on project feasibility and financial review.

- Begin Construction: Once approved, funds are disbursed in stages as construction progresses.

This structured approach ensures transparency and ease in securing financing for your commercial project.

Research and Preparation

Before applying for a commercial construction loan, thorough research and preparation are essential steps to ensure a smooth process:

- Assessing your financial situation: Evaluate your project’s financial requirements and determine how much funding you need. This step helps in understanding your borrowing capacity and planning accordingly.

- Gathering necessary documentation: Collect all required documents such as financial statements, project plans, and contractor details. Having these ready streamlines the application process and facilitates quicker approval.

These steps lay the groundwork for a successful construction loan application, providing clarity and preparation in navigating the financing process.

Choosing a Lender

When selecting a lender for your commercial construction project, consider these options:

- Local banks and credit unions: These institutions often offer personalized service and local market expertise, which can be beneficial for navigating specific regional regulations and conditions.

- National lenders with construction loan programs: Larger banks and financial institutions may provide specialized construction loan programs, offering competitive rates and broader financing options suitable for larger projects or multi-state operations.

Choosing the right lender is important for securing the best terms and support throughout your construction loan process.

Application Process

Navigating the application process for a commercial construction loan involves these key steps:

- Initial consultation with the lender: Schedule a meeting to discuss your project details, financing needs, and the lender’s requirements. This consultation helps establish expectations and clarifies the next steps.

- Submitting your application: Complete the application form provided by the lender, including all required documentation such as financial statements, project plans, and contractor details. Submitting a thorough and accurate application improves your chances of approval and expedites the review process.

These steps are key in initiating your commercial construction loan application, ensuring all necessary information is provided to facilitate a smooth approval process.

Loan Approval

Securing approval for your commercial construction loan involves these critical stages:

- Underwriting process: The lender evaluates your application, reviewing financial documents, project feasibility, and other pertinent factors to assess risk and determine loan terms.

- Conditional approval and final approval: After initial underwriting, you may receive conditional approval pending additional documentation or requirements. Final approval follows once all conditions are met, confirming your loan terms and enabling funding disbursement.

Understanding these stages helps navigate the loan approval process effectively, ensuring clarity and readiness for your construction project.

Working with Builders and Contractors

During the construction loan process, partnering with experienced builders and contractors is crucial.

- Selecting a reputable builder or contractor: Choose professionals with a proven track record in commercial construction to ensure quality and reliability.

- Importance of detailed project plans and cost estimates: Clear plans and accurate cost estimates are essential for budgeting and securing loan approval.

- Builder’s role in the loan process: Builders provide project oversight and ensure milestones align with loan disbursements.

Partnering with Contour Construction ensures expert guidance and support throughout your project.

Managing Construction Loan Funds

Effective management of construction loan funds is crucial for project success.

- Draw schedule and disbursement of funds: Establish a clear schedule for fund releases tied to project milestones.

- Monitoring the construction progress: Regular oversight ensures projects stay on track and within budget.

- Importance of staying within budget: Adhering to financial plans avoids delays and ensures funds meet project needs.

Contour Construction provides expert oversight and support, ensuring your project progresses smoothly.

Closing The Loan

Finalizing your construction loan involves these key steps:

- Transition from construction loan to permanent mortgage: Once construction is complete, the loan converts to a long-term mortgage.

- Final inspection and approval: Ensure the project meets all agreed-upon specifications before finalizing.

- Closing costs and final documentation: Complete paperwork and settle any closing fees to close the loan officially.

Why you should Build in Frederick – Market Growth

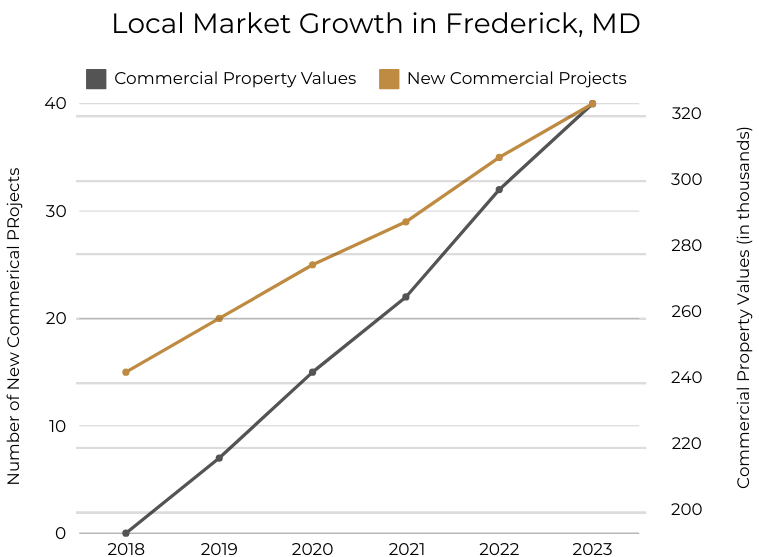

Frederick, MD, has seen remarkable commercial market growth in recent years. The area and line chart below highlight the expansion of the local market, showcasing both the number of new commercial projects and the growth in commercial property values.

- Number of New Commercial Projects: Represented by the blue shaded area and line, this shows a steady increase from 15 projects in 2018 to 40 projects in 2023.

- Commercial Property Values: Represented by the green line, this indicates a significant rise in property values from $200,000 in 2018 to $330,000 in 2023.

This visual representation illustrates the robust growth and burgeoning opportunities in Frederick’s commercial market, making it an attractive destination for new developments.

Build Your Destination with Confidence in Frederick, MD With Contour Construction

Ready to elevate your commercial construction project in Frederick, MD? Trust Contour Construction to navigate the loan process with expert advice and personalized support. Contact us today at (240) 405-0123 to learn more about how we can help you achieve your vision. Visit our website for more information on our services and past projects.